Bihar Board 12th Accountancy Important Questions Long Answer Type Part 3 in English

Bihar Board 12th Accountancy Important Questions Long Answer Type Part 3 in English

BSEB 12th Accountancy Important Questions Long Answer Type Part 3 in English

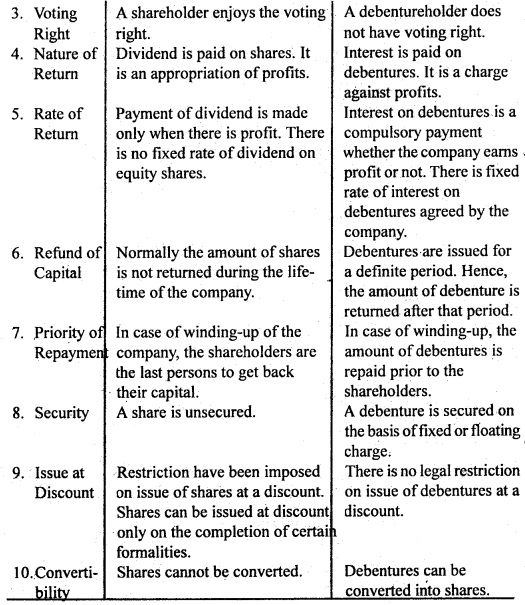

Question 1. Distinguish, between a Share and a Debenture.

Answer: Difference between a Share and a Debenture: The following table indicates the difference between a share and a debenture:

Question 2. Describe ike various types of debentures.

Answer: Types of Debentures: Following are the various types of Debentures:

1. Registered Debentures: The debentures which are recorded in the Register of Debenture holders are called registered debentures. Payment of interest or repayment of the principal sum will be made only to the registered holder. Such debentures are transferable only by transfer deed. In other words, it cannot be transferred by mere delivery.

2. Bearer Debentures: Bearer debentures are those which are payable to the bearer or holder. Such debentures are transferable by delivery. The payment of interest is made through the company which arc attached with the debentures. No register is maintained foç.bearer debentures.

3. Mortgage or Secured Debentures: Mortgage debentures are those debentures that are secured by creating a fixed or floating charge on the assets of the company. This means that if the company commits any default in paying interest or in repaying the principal sum, the debenture holders have the right to recover their dues from the mortgaged property. Mortgage debentures are also known as ‘Secured Debentures’. Secured debentures are those that are secured against some particular assets of the company.

Mortgage debentures may be classified as:

(a) First Debentures: These are debentures that are repayable in priority to other debentures.

(b) Second Debentures: These are debentures that are repayable only after the redemption of the first debentures.

4. Simple, Naked or Unsecured Debentures: The debentures for which the company does not offer anything by way of security are called simple or naked debentures. They are also called ‘Unsecured Debentures’. These debentures carry a fixed rate of interest and are repayable after a specified period.

5. Redeemable Debentures: Redeemable debentures are those debentures that are repayable by the company on a specified date or within a specified period. Repayment of these debentures may be in lump-sum or in instalments, depending upon the terms of the issue.

6. Irredeemable Debentures: Irredeemable debentures are those debentures that are not payable during the lifetime of the company. Such debentures become repayable only on liquidation of the company.

7. Convertible Debentures: Convertible debentures are those debentures that can be converted into shares at a specified date or within/after a specified period. Conversion takes place as per the terms of the issue.

8. Non-convertible Debentures: These are the debentures, the holders of which have no right to convert them into equity shares.

9. From coupon Rate (Interest) point of view: From the coupon rate (interest) point of view, debentures may be classified into two categories:

(a) Debentures issued with coupon rate: Debentures issued with specified rate of interest, e.g., 12% or 14% is called the coupon rate.

(b) Debentures issued without coupon rate: A debenture without coupon rate is one that does not carry a specified rate interest. It is also called as a‘Zero Coupon Bond’or‘Deep Discount Bond’.

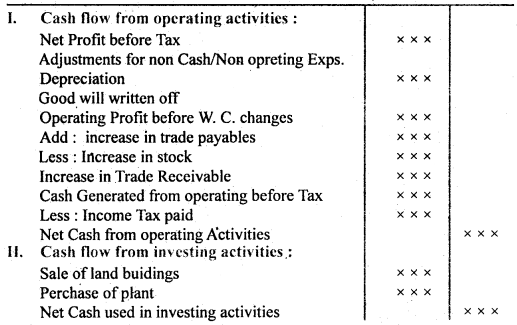

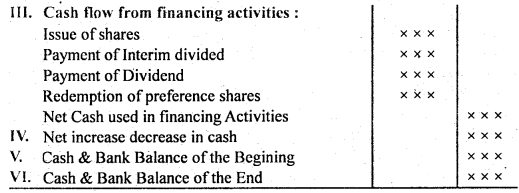

Question 3. Prepare an imaginary proforma of Cashflow statement.

Answer: Imaginary proforma of Cash Flow:

Statement

Question 4. Explain the major headings of the liabilities side of il: Company’s Balance Sheet as per Schedule VI.

Answer: Explanation of Different Items of Liabilities side of Balance Sheet:

1. Share Capital: The heading ‘Share Capital’ should disclose authorised, issued, subscribed and paid-up capital stating the number and nominal value of the shares. If preference shares have been issued, the share capital will also disclose the relevant information. Calls-in-arrear is to be shown as a deduction from (he called-up amount; the amount due from directors is to be stated separately.

Calls-in-advance is to be shown as a separate item. Forfeited Shares Account must be shown as an addition to subscribed capital. Shares allotted for consideration other than cash, e.g., shares issued to vendors and shares issued as bonus shares must be separately stated.

2. Reserves and Surplus: Under this heading, all those reserves which have been created out of undistributed profits are shown.

Here these items will be shown separately:

- Capital Reserve,

- Capital Redemption Reserve,

- Securities (Share) Premium,

- Sinking Fund,

- Other Reserves,

- Balance of Profit & Loss Account (Cr.).

3. Secured Loans: Secured loans are loans that are secured against tangible assets. Debentures are always secured either on fixed charge or floating charge. Loans from banks, subsidiaries etc. are also shown under this heading if they are secured. Interest accrued and due on secured loans is also shown under this heading.

4. Unsecured Loans: Unsecured loans do not carry any charge on the assets and include fixed deposits and loans and advances from bank etc. Unsecured loans are classified into short-term loans and advances and other loans and advances. Short-term loans and advances are the loans and advances which become due for payment within one year from the date of the Balance Sheet.

5. Current Liabilities and Provisions: This heading has two sub-headings:

(a) Current liabilities: Current liabilities include the following:

- Sundry Creditors,

- Bills Payable,

- Advance Payments,

- Unclaimed Dividends, and

- Acceptances, Bank Overdraft, etc.

(b) Provisions: Provisions include the following:

- Provision for Taxation,

- Proposed Dividend,

- Provision for Contingencies,

- Provision for Provident Fund,

- Provision for Pension and Similar StafFBenefit Schemes, etc.

Provision for depreciation and provision for doubtful debts may be shown as deductions from the amounts of concerned assets.

6. Contingent Liabilities: A contingent liability is a liability that comes into existence on the happening of an uncertain event. For example, liability on account of bills discounted with the bank is a contingent liability. If contingent liabilities are not provided for in the books, they will appear below the Balance Sheet by way of footnotes under the heading contingent liabilities.

It includes the following:

- Claim against the company not acknowledged as debts.

- Uncalled liability on shares partly paid,

- Arrears of fixed cumulative dividends,

- Liabilities on Bills discounted,

- The estimated amount of contracts remaining to be executed on Capital Account and not provided for.

- Other money for which the company is contingently liable.

Question 5. Write six limitations of Analysis of Financial Statements.

Or, Describe the limitations of Financial statements.

Answer: Limitations of Financial Analysis: Financial analysis has the following limitations:

1. Suffering from the Limitations of Financial Statements: Financial statements suffer from a variety of weaknesses. So analysis based on these statements cannot be said to be always reliable.

2. Unreliable Comparison: There are different methods for charging depreciation and valuation of the stock. Interest may be charged at different rates. In this way, there is sufficient possibility of manipulation and the financial statements have to suffer. As a result financial analysis also proves to be defective. In fact, in many cases comparisons are unreliable.

3. Ignoring Price-level Changes: The results shown by financial statements may be misleading if price-level changes have not been accounted for. Changes in price affect the cost of production, sales and value of assets as a consequence comparability of ratios also suffers.

4. Ignoring Qualitative Aspect: Financial analysis does not measure the qualitative aspect of the business. It does not show the skill, technical know-how and efficiency of its employees and managers.

5. Financial Analysis is only a tool, not a Final Remedy: Analysis is a financial statement is a tool to measure the profitability, efficiency and financial soundness of the business. It should be noted that personal judgement of the analysis is more important in financial analysis. We should not rely on a single ratio.

6. Different Techniques of Analysis: There are so many techniques for the analysis of financial statements. Therefore, the analysis, interpretation and results are of different types. It creates confusion in the mind of the analyser.

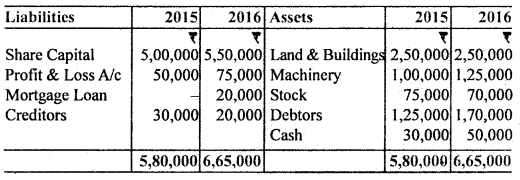

Question 6. Following are the Balance Sheets of Ganesh Gee Ltd.:

Balance Sheets of Ganesh Gee Ltd.

(as on March 31, 2015, and 2016)

Prepare Comparative Balance Sheet of Ganesh Gee Ltd.

Answer:

Comparative Balance Sheets of Ganesh Gee Ltd.

(as of 31 st March 2015 and 2016)

Question 7. State ¡he importance of Financial Analysis to User-Groups.

Answer: Important of Financial Analysis to User-Groups: Financial statements provide useful information about the activities of a business entity to various individuals or groups. These statements are used in making judgements and decisions. The users of financial statements include owner(s), shareholders, present and potential investors, creditors, suppliers, employees, management, taxation authorities, Governments and regulatory authorities, customers, consumers, the public and others. Some of these users have a direct financial interest in the business concern whereas some users or user groups have an indirect financial interest.

The importance of financial statements to various users may be stated as ’ under:

(A) Users with Direct Financial Interest:

1. Owners/Shareholders: They are interested in knowing the earning capacity of the business, its financial soundless and the likelihood of future returns.

2. Creditors: The creditors are interested in knowing whether the company will have enough cash to pay interest charges and repay the debt at the due date. For this, the company’s liquidity and cash flow position should be analysed.

3. Suppliers: To suppliers, a business enterprise is a source of cash in the form of payment for goods or services supplied. Suppliers are interested in a company’s ability to generate adequate cash flows towards the payment of goods and services supplied. This can be decided on the basis of the analysis of the company’s financial statement.

4. Employees: Like shareholders, creditors and suppliers, the employees too have a direct financial interest in a company. Prospective and present employees may use the financial statements to assess the risk and growth potential of the company. They are interested in job satisfaction, job security, promotional avenueS, bonus declaration etc. So they want information regarding profitability etc.

5. Management: Management is one of the most important users of financial statements. Financial statements provide useful information to the management for planning, control, performance, measurement and decision-making. The analysis also helps in performing many activities and functions in the company.

(B) Users with Indirect Financial Interest:

6. Government and Regulatory Agencies governmental and regulatory agencies are concerned with the financial activities of business organisations for purposes of regulation to protect the public interest.

7. Bankers and Other Financial Institutions: Bankers and financial institutions are interested in the security of the loan advanced, equity’s capacity to repay the principal and interest as per terms. So they are interested in earning capacity and financial soundness of the company.

8. (a) Present Investors: Present investors are interested in the future growth, and financial soundness of the company. They analyse statements to determine whether they should buy, hold or sell the shares.

(b) Potential Investors: Potential investors analyse financial statements with a view to deciding whether they should buy the shares or not.

9. Other Users: The analysis of financial statements is also important from the viewpoint of consumers, stock exchanges, brokers, underwriters, economists, planners, chambers of commerce, researchers, the general public and the financial, press. They are more concerned about business enterprises as well as the effects of these enterprises that these enterprises have on the environment, social problems, inflation and quality of life. In fact, they are interested in financial analysis from their own point of view.

Question 8. Write the tools of Financial Analysis.

Answer: Tools or Techniques or Methods of Financial Analysis: There are various tools for financial analysis depending on the purpose.

The important tools or techniques of financial analysis are as follows:

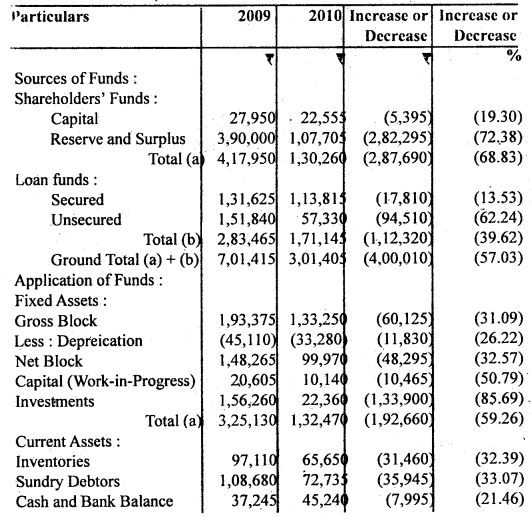

1. Comparative Statements: Statement showing financial data for two or more than two years, placed side by side to facilitate comparison are called Comparative Financial Statements.

Any financial statement that reports the comparison of data of two or more consecutive accounting periods is known as a Comparative Financial Statement. Such a statement spotlights trends and establishes a relationship between items that appear on the same row of a Comparative Financial Statement. It discloses changes in items of financial statements over time in both rupees and percentage form.

Each item (such as debtors) on a row for one fiscal period is compared with the same item in a different period. The analyst calculates the absolute changes, the difference between the figures of one year and the next, and also the percentage change (increase or decrease) from one year to the next, using the earlier year as the base year.

Comparison of financial statements can be ‘intra-firm’ or ‘inter-firm’. When financial statements of two or more years of the same firm are presented and compared, it is referred to as an intra-firm comparison. When financial statements of two or more firms are compared over a number of accounting periods, it is called inter-firm comparison.

2. Common size Statements:

Meaning: Common size statements is a statement expressing all items of a financial statement as a percentage of some measure of the size of the enterprise. Thus, the Common size financial statement shows the percentage of each item to the total in each period. If the Balance Sheet and Income Statement items are shown in analytical percentage i.e., percentages or ratios to the total of appropriate items (total assets, total liabilities, and total net sales) a common base for comparison is provided.

The statements in this form are called Common size- Statements. Such statements are useful in studying the comparative financial position of two or more businesses. In common size statements, vertical analysis is required.

3. Ratio Analysis: An analysis of financial statements with the help of ratio may be termed as ratio analysis. It describes the relationship which exists between various items of a Balance Sheet and a Profit and Loss Account of a firm. In short, ratio analysis may be defined as the process of computing and presenting the relationship of items and groups of items of the financial statements.

4. Cash Flow Statement: Cash flow statements may be defined as the statement showing ‘Cash inflows’ and ‘Cash outflows’ of an organization during the specific period’. The difference between the ‘inflow’ and ‘outflow’ of cash is the ‘net cash flow’. Cash Flow Analysis summarises the causes for the changes in the cash position of a business enterprise between the dates of two balance sheets.

5. Fund Flow Statement: A fund flow Statement is basically a tool of financial analysis. This statement explains the changes in Working Capital and their effect on financial position. It indicates by what means new financing was obtained and for what purposes it was utilized.

6. Trend Analysis: Trend analysis is also an important tool for the analysis and interpretation of financial statements. The trend means tendency in general terms. Trend analysis discloses changes in the financial and operating data of financial statements over a series of years in percentage.

The trend analysis of business operations and other financial data may be done in any of the following ways

- Trend Percentage,

- Trend Ratios, and

- Graphic or Diagrammatic Presentation.

Question 9. What are Cashflow statements? How it is prepared?

Answer: A cash flow statement can be defined as a statement which summarises sources of cash inflows and uses of cash outflows of a firm during a particular period of time, say a month or a year.

A statement of changes in financial position on a cash basis is commonly known as the cash flow statement. It shows the changes in cash position from one accounting period to another, in other words, the cash flow statement summarizes the causes of changes in cash and cash equivalents position between dates of. two balance sheets. It indicates the sources and uses of cash. This statement attempts to analyze the transactions of the firm in terms of cash.

According to Account Standard-3 (revised), the cash flow statement should be presented in a manner that it reports cash flows, during the period classifying by

- Cash flows from operating activities.

- Cash flows from investing activities.

- Cash flows from financing activities

1. Cash flows from operating activities: Cash flows from operating activities are the cash flows from the principal revenue-producing activities are to purchase sugarcane and other inputs; payment of wages and salaries, sale of sugar, and by-products.

Examples of cash flow from operating activities: Account Standard- 3 (revised) gives the following examples of cash flows from operating activities:

- Cash receipts from the sale of goods and services.

- Cash receipts from royalty, fees, commissions, and other revenues.

- Cash payments to suppliers of inputs and services used.

- Cash payment to and on behalf of employees.

- Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities.

- Cash receipts and payment relating to ‘future contracts’ ‘option contacts’ and ‘swap contact’ when the contracts are used for dealing or trading purposes.

2. Cash flows from investing activities: Cash flows from investing activities are the cash flows from the transactions involving purchase and sale of resources i.e., long-term productive assets intended to generate future and cash flows.

Examples of cash flow from investing activities: Account Standard-3 (revised) gives the following examples of cash flows investing activities:

- Cash payments to acquired fixed assets including intangible assets such as goodwill, patents, and copyrights. It also includes payment made to construct fixed assets.

- Cash receipts from disposal of fixed assets including intangibles.

- Cash receipts from the sale of shares, warrants, or debts instruments and interest in joint ventures.

3. Cash flows from financing activities: Cash flows from financing activities are the cash flows from the transactions relating to providing funds (both capital and borrowings) to the company.

Examples of cash flows from financing activate: Account Standard-3 (Revista) gives the following examples of cash flows from financing activities,

- Cash proceeds from issuing shares or other similar instruments,

- Cash repayment of amounts borrowed and

- Cash proceeds from issuing debentures, loans, notes, bonds, and other short-term or long-term borrowings.

Question 10. What do you mean by Accounting Ratio? What are its objectives?

Answer:

Meaning of Accounting Ratios:

- Ratio: “A ratio is an expression of the quantitative relationship between two numbers.”

- Analysis: Analysis means examination and interpretation of the numerical relationship of two numbers.

- Ratio Analysis: Ratio analysis means examination and interpretation of the numerical relationship of two numbers. In financial analysis, a ratio is used as an index or yardstick for evaluating the financial position and performance of a firm. According to Myers, “Ratio analysis is a study of the relationship among the various financial factors in business.”

- Accounting Ratios: The ratios based on financial statements are called ‘Financial Ratios’ or ‘Accounting Ratios’. In short, when “ratios are expressed on the basis of accounting information such ratios are called accounting ratios.”

“A ratio is simply one number expressed in terms of another. It is found, by dividing one number into the other Anthony

According to J. Batty, “The term ‘accounting ratios’ is used to describe the significant relationship which exists between two figures shown in Balance Sheet and Profit & Loss Account or in any part of the accounting organization.”

Objectives (or Purposes) of Accounting Ratios:

The following are the main objectives of ratio analysis:

- To Measure the Profitability of the Concern: The profitability can be measured by gross profit, net profit, operating profit ratios.

- To Determine the Operating Efficiency of the Business: Operational efficiency of the business can be judged by calculating operating/ activity ratios.

- To Assess the Solvency of the Business: Solvency or otherwise of the business concern may be assessed by calculating solvency ratios.

- To Help in Forecasting and Budgeting: Ratio analysis helps in getting knowledge of the profitability and financial position of the business undertaking. It also reveals the strength and weaknesses of the business concern. It helps in forecasting, budgeting, and making plans for the future.

- To Simplify and Summarise Accounting Information; Ratio analysis makes the accounting information meaningful.

- To facilitate Comparative Analysis,

- To help Management in decision-making.

- To help in Financial Planning.

Question 11. Explain the importance of the Accounting Ratio.

Answer: Importance of Accounting Ratios: The importance of accounting ratios can be understood by the following discussion:

(A) Importance for Management:

- Accounting ratios make the figures simple and understandable.

- Accounting ratios provide the basis for preparing budgets and also determining future lines of action i.e., forecasting.

- Accounting ratios facilitate comparative analysis of the performance.

- Accounting ratios help in making decisions from the information provided in the financial statements.

- Accounting ratios indicate efficiency and the profitability of the business concern.

- The financial strength and weaknesses of a firm are communicated in a more easy and understandable manner by the use of ratios.

- The operational efficiency of the business can be ascertained by calculating the operating ratio.

- Accounting ratios help in assessing the solvency position of the business.

- Accounting ratios help in measuring the short-term and long-term financial position of the company.

(B) Importance of Investors:

An investor in the company will like to assess the financial position of the concern where he is going to invest his funds. The investor will feel satisfied only if the concern has a sufficient amount of assets. Long-term solvency ratios will help him in assessing the financial position of the concern. Profitability ratios, on the other hand, will be useful to determine the profitability position of the concern. Thus, ratio analysis will be useful to the investor in making up his mind whether the present financial position of the concern warrants further investment or not.

(C) Importance of Short-term Creditors:

The creditors or suppliers extend short-term credit to the concern. They are interested to know whether the financial position of the concern warrants their payments at a specified time or not. The concern pays short-term creditors out of its current assets. If current assets are quite sufficient to meet current liabilities, then the creditors will not hesitate in extending credit facilities. Current and liquid ratios will give an idea about the current financial position of the concern.

(D) Importance of Employees: The employees are also interested in the financial position of the concern especially in relation to profitability. Their wages increases and the number of fringe benefits are related to the volume of profits earned by the concern. The employees make use of information available in financial statements. Various profitability ratios relating to gross profit, operating profit, net profit, etc. enable employees to put forward their viewpoint for the increase of wages and other benefits.

(E) Importance of Government: Government is interested to know the overall Strength of the industry. Various financial statements published by industrial units are used to calculate ratios for determining short-term, long- terra, and Overall financial position of the concerns. Profitability indices can also be prepared with the help of ratios. The government may base its future policies on the basis of industrial information available from various units. The ratios may be used as indicators of the overall financial strength of the public as well as the private sector. In the absence of reliable economic information, governmental plans and policies may not prove successful.

Question 12. What is a Cash Flow Statement? What are its objectives?

Or, Describe the objectives and importance of the Cash Flow Statement.

Answer: Meaning of Cash Flow Statement: A statement of changes in financing position on a cash basis is commonly known as the cash flow statement. It shows the changes in cash position from one accounting period to another. In other words, the cash flow statement summarises the causes of changes in cash and cash equivalents position between dates of two Balance Sheets. It indicates the sources and uses of cash. This statement attempts to analyze the transactions of the firm in terms of cash.

Thus, a Cash Flow Statement can be defined as a statement which summarises sources of cash inflows and uses of cash outflows of the firm during a particular period of time, says, a month or a year.

Objectives of Cash Flow Statement:

The main objectives of preparing a Cash Flow Statement are as follows:

1. To Throw light on Specific Sources of Cash Flow: A cash Flow Statement is prepared to highlight cash generated from various activities (i.e., inflow of Cash from Operating, Investing, and Financing Activities).

2. To Ascertain the Specific Uses: The cash Flow Statement is prepared to highlight the specific uses or outflows in various activities and projects.

3. To Ascertain the Net Change in Cash and Cash Equivalents: The cash Flow Statement is prepared to indicate the difference between total sources and total uses between the dates of two Balance Sheets.

4, To Disclose Changes in Cash Position: Cash Flow Statement discloses the reasons for low cash balance in spite of heavy operating profits or for heavy cash balance in spite of low profits.

5. To Determine Cash Requirement: A projected cash flow statement is prepared to determine cash requirements in various investment projects.

6. For Efficient Cash Management: Cash Flow Statement heals in planning the investment of surplus cash in short-term investments and to plan short-term credit in advance for the deficit.

7. To Judge Liquidity Position liquidity is the ability of the business enterprise to pay current liabilities as when it becomes due. The Cash Flow Statement helps to ascertain the liquidity in a better manner.

8. To Help in Short-term Planning: A cash Flow Statement provides information for planning the short-term needs of the firm.

9. To Analyse Financial Position: Cash Flow Statement proves to be useful for bankers and money lending institutions. It helps them in reviewing the financial position of the borrowers.

10. To Help in Dividend Decision Cash Flow Statement shows whether the company will be able to pay dividends in cash or not. It helps in taking decisions regarding the payment of dividends.

Utility/Importance or Uses of Cash Flow Statement:

There is a great importance of cash flow statements in financial management. It is an essential tool of financial analysis for short-term planning.

The main advantages of cash flow statement are as follows:

- Gash flow statement aims at highlighting the cash generated from operating activities.

- Cash flow statement helps in planning the repayment of loan schedule and replacement of fixed assets etc.

- Cash is the center of all financial decisions. It is used as the basis for. the projection of future investing and financing plans of the enterprise.

- A cash flow statement helps to ascertain the liquidity position of the firm in a better manner. Banks and financial institutions mostly prefer cash flow statements to analyze the liquidity of the borrowing firm.

- Cash flow statement helps in efficient and effective management of cash.

- The management generally looks into cash flow statements to understand the internally generated cash which is best utilized for payment of dividends.

- Cashflow statement is useful as a tool of historical analysis as it helps to answer questions such as given below

1. What is the liquidity position of the firm?

2. What are the causes of changes in the firm’s cash position?

3. What fixed assets are acquired by the firm?

4. Did the firm used external sources of finance to meet its needs of funds?

5. What were the significant investments and financing activities of the firm which did not involve working capital?

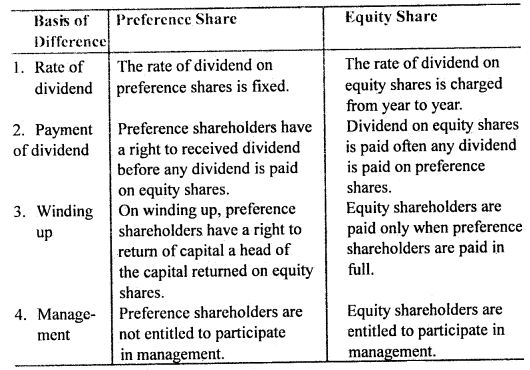

Question 13. Difference between preference share and equity share.

Answer: The difference between preference share and equity share are as follows:

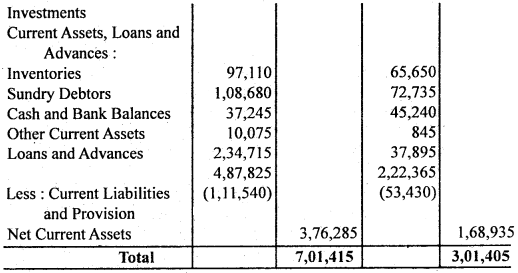

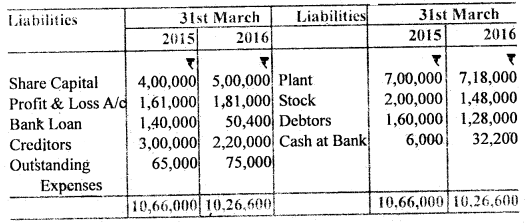

Question 14. From the following Balance Sheets as of 31st March 2015 and 2016, you are required to calculate Cash Flow from Operating Activities for the year ended 31st March 2016:

Balance Sheets

(as of 31st March 2015 and 2016)

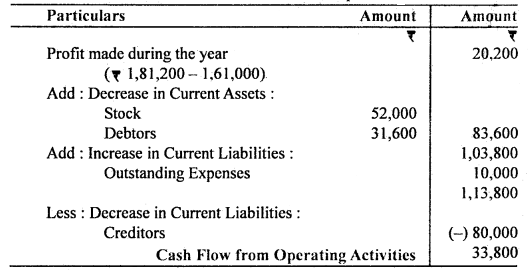

Answer:

Calculation of Cash Flow from Operating Activities

Note: Bank Loan has been assumed as a non-current liability.

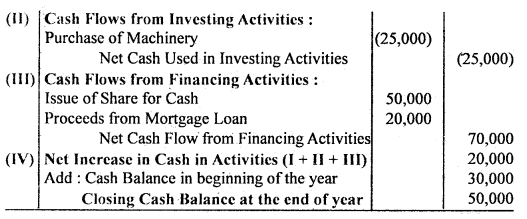

Question 15. From the following Balance Sheet of M. Ltd., prepare Cash

Answer:

Cash Flow Statement (Indirect Method)

(for the year ended 31 st March 2016)

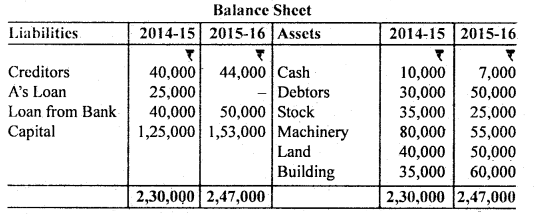

Question 16. Prepare Cash Flow Statement from the Balance Sheet of Mohan Ltd. for the year ended 31st March 2016:

Balance Sheet

During the year, a machine costing 10,000 (accumulated depreciation ₹ 3,000) was sold for ₹ 5,000. Depreciation provided during the year was ₹ 18,000. Prepare Cash Flow Statement.

Answer:

Cash Flow Statement

(for the year ended 31 st March 2016)

Question 17. Discuss the features of u company.

Answer: Essential features of a company: Following are the essential features (characteristics) of a company.

- Association of persons: A company is an association of persons, usually for profit.

- Artificial person: It is an artificial person created by law.

- Separate legal entity: It has a separate legal entity from its members. So, it can sue and can be sued in its own name. It can own or dispose of the property in its own name.

- Limited liability: It has limited liability. The liability of members is limited to the extent of the face value of shares held by them.

- Perpetual succession: A company is an artificial person who never dies. It has continuous existence. It is a creation of law. So, its existence can be terminated only by law. It is not affected by the death of its members.

- Common seal: It has a common seal that acts as the official signature of the company. Any document without the common seal of the company is not binding up the company.

- Transferability of shares: The capital of a company is divided into shares. The shares of a company are freely transferable except in the case of a private company.

- Separation of ownership and management: In companies, there is a divorce between ownership and management. It is owned by members (i.e., shareholders but it is managed by the Board of Directors who are elected by shareholders. Members of a company can not directly participate in the management of the business of the company.

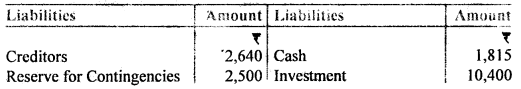

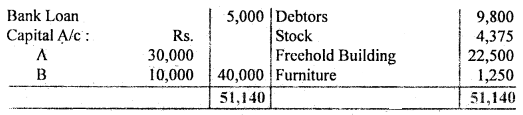

Question 18. A and B are in partnership sharing profits and losses in the proportion of 3/5 and 2/5. The following was their Balance Sheet as of 31st March,12016:

They decided to dissolve the partnership on this date and the assets, with the exception of the investment and cash, were sold for Rs. 34,000. The market value of Investment was Rs. 11,000 which was taken over by B who also agreed to discharge Bank Loan. The expenses of winding up were Rs. 550. The creditors were paid Rs. 2,515 in full settlement.

You are required to prepare Realisation A/c, Cash A/c, and Partners Capital A/c.

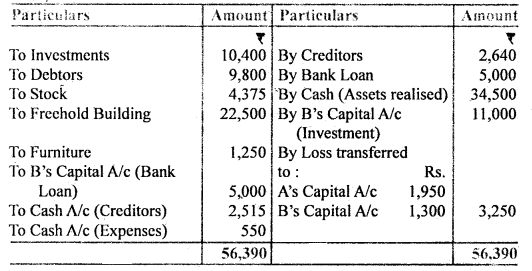

Answer:

Realisation Account

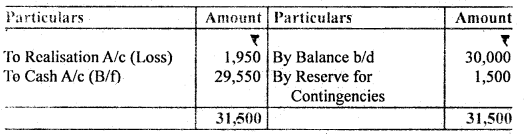

A’s Capital Account

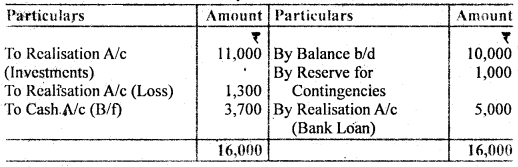

B’s Capital Account

Cash Account

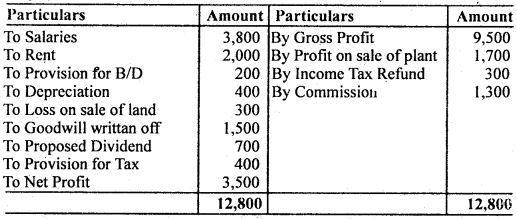

Question 19. Calculate Cash flow from operating activities from the following Profit & Loss A/c:

Answer:

Cash Flow from Operating Activities

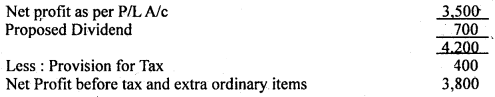

Working Notes:

Calculation of Profit before Tax

Question 20. What is a partnership? What are its chief characteristics? Explain.

Answer: Meaning of Partnership:

The partnership is an agreement written / oral between two or more persons who have agreed to do some lawful business and to share profit or loss arising from the business.

According to the Indian Partnership Act, 1932, Section – 4, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

In partnership, two or more persons join hands to set up a business and share its profits and losses.

Persons who have entered into a partnership with one another are called individually partners and collectively ‘a firm’ and the name under which their business is carried on is called the ‘firm name’. A partnership firm is not a separate legal entity apart from the partners constituting it.

There must be a minimum of two persons to form a partnership firm, according to the Indian Partnership Act, 1932, but it does not specify the maximum number of partners. In this issue section, 11 of the companies act 1956 limits the number of partners to 10 for a partnership carrying on banking business and 20 for a partnership carrying on any other type of business.

Characteristics of Partnership:

1. Two or more persons: There meant to be a minimum of two persons to form a partnership firm, according to the Indian Partnership Act, 1932, but it does not specify the maximum number of partners. In this issue Section 11 of the Indian Companies Act, 1956. limits the number of partners of 10 (ten) for a partnership carrying on banking business and 20 (twenty) for a partnership carrying on any other type of business.

2. Agreement: Partnership comes into existence on account of an agreement among the partners, and not from the status or operations of the law. The agreement becomes the basis of the relationship between the partners. It may be written or oral. It may be for a fixed period or for a particular venture or at will.

3. Business: A partnership can be formed for the purpose of carrying on some lawful business with the intention of earning profits. Mere co-ownership of a property does not amount to a partnership.

4. Mutual agency: The partnership business may be carried on by all the partners or any of them acting for all. This statement means that every ‘ partner is entitled to participate in the conduct of the affairs of its business and there exists a relationship of mutual agency between all the partners. Partners are agents as well as principals for all other partners. Each partner can bind other partners by his acts and also is bound by the acts of other partners with regard to the business of the firm. The relationship of the mutual agency is so important feature of partnership that one can say that there would be no partnership if this feature is absent.

5. Sharing of profit: The agreement between the partners must be to share the profits (or losses). Though the definition of partnership, according to Partnership Act, describes partnerships relation between people who agree to share the profits of a business, the sharing of loss is implied. If some persons join hands for the purpose of some charitable activity, it will not be termed as a partnership.

6. Liability of partnership: The liability of partnership is unlimited. Each partner is liable jointly with all the other partners and also individually to the third party for all acts of the firm done while he is a partner.

Question 21. Why there is a need for the revaluation of assets and liabilities on the admission of a partner?

Answer: At the time of admission of a partner, it is necessary to assess the correct and current value of assets and liabilities of the firm shown in books because the current value of various assets and liabilities may be different from the values shown in the balance sheet. To revalue the assets and liabilities new account is opened called Revaluation Account. To revenue the assets and liabilities, all necessary adjustments are made through the Revaluation Account or Profit and Loss Adjustment Account.

Revaluation of assets and liabilities is needed at the time of admission so that the profit or loss arising on account of such revaluation maybe adjusting the old partner’s Capital Account in Old profit sharing ratio and the new partner may not be affected by the profit or loss on account of revaluation of assets and liabilities.